- Parkway Schools

- Home

- 2025 Retiree Benefits

Benefits

Page Navigation

- Home

- CareATC - Employee Clinic

- Life Event Instructions

- Dental and Vision Information

- Life Insurance

- Employee Wellness

- UHC Wellness Programs

- EAP and Mental Health

- FSA - Medical and Dependent Care

- 403b/457b

- Public Service Loan Forgiveness Program

- Women & Children's Health, Privacy, Etc.

- Transparency in Coverage

- 2026 Health Insurance Planning

- New Retiree Benefits Enrollment

-

2025 RETIREE BENEFITS

Changes effective on 01/01/2025:

-

MEDICAL PREMIUM INCREASE | Rising Cost of Healthcare

UNITED HEALTHCARE

- United Healthcare premiums are increasing by an average of 6.0%

- Retirees on United Healthcare may see changes to their copay, deductible, coinsurance, and out-of-pocket max

- Click on "MEDICAL PLAN DESIGN" below for more information

ANTHEM & AETNA

Medicare Advantage plan rates are increasing significantly next year due to rising healthcare costs and new regulatory changes. Additionally, the upcoming elimination of the Medicare Part D “donut hole” in 2025, which introduces a $2,000 cap on out-of-pocket prescription drug costs, is contributing to these rate hikes as insurance carriers adapt to these coverage requirements.

For more information, click here or contact Anthem or Aetna directly.

- Anthem Medicare Advantage plan premium increased to $352.43 (an increase of $95.73 per member per month)

- Aetna Medicare Advantage plan premium increased to $357.47 (an increase of $53.00 per member per month)

- The plan design for Anthem and Aetna will remain the same

-

MEDICAL PLAN DESIGN | Base, Premium, High Deductible

As part of our ongoing efforts to manage rising healthcare costs and provide comprehensive benefits, the district is making adjustments to the plan designs for two (2) of our three (3) medical plans: the Base Plan and the High Deductible Health Savings Account (HDHSA) Plan.

The Premium plan: no changes to plan design.

The Base plan: The deductible will remain the same $650/$1300. The out-of-pocket maximum (OOP) will increase from $2,000/$4,000 to $3,000/$6,000.

The HDHSA plan: The deductible will increase from $3,200 to $3,400 to comply with updated IRS regulations for high-deductible health plans.

-

EXPRESS SCRIPTS | Pharmacy Benefits Manager

For United Healthcare Pharmacy Claims:

Parkway School District will be transitioning from CVS to Express Scripts (ESI) for our pharmacy benefit plan. This change will result in significant cost savings for the district, which allows us to mitigate further changes to medical premiums and plan design.

We expect very little disruption during this transition.

Please contact your doctor or Express Scripts directly for any questions regarding your prescriptions.

Our transition to Express Scripts (ESI) may impact the coverage for certain medications. This can happen for a few reasons, but is usually a result of formulary changes.

Formulary Changes: Each pharmacy benefit provider has a list of covered medications, known as a formulary. ESI's formulary may differ from the one used by CVS. ESI’s formulary may exclude certain brands or manufacturers, but may include others that CVS does not. Additionally, some medications could require a different process for approval than you are used to with CVS.

If your medication is impacted by the transition, you will receive a letter with information on the next steps, including potential alternatives or processes to request coverage.

Additional Benefits - No Changes:

-

Dental | Vision

No changes to cost or plan design for Dental or Vision insurance for the 2025 plan year.

-

CareATC

Continued access to the Parkway employee clinic for Retirees on our United Healthcare coverage!

-

Wellness

Continued access to Wellness programs for Retirees on United Healthcare.

All Retirees have access to the Parkway Employee Assistance Program through PAS.

For more information, please email benefits@parkwayschools.net or call (314) 415-8059.

External Links

-

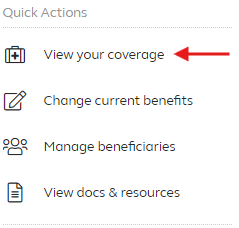

HOW TO ACCESS ALIGHT WORKLIFE:

-

1. Click here to access your Alight Worklife portal.

2. Login with your username and password. Contact the benefits department if you need these credentials.

Click "Reset Password" if you have access issues.

Frequently Asked Questions

-

What if I want to make changes after open enrollment?

Posted by:After open enrollment, your benefits elections are generally locked until the next open enrollment period. However, there are some circumstances where exceptions to this rule are allowed; these are called Qualified Life Events (QLE).

The following are QLEs:

- Getting married or divorced

- Having a baby or adopting a child

- Spouse/Dependent loses health coverage

- Death of Spouse/Dependent

Important Note: You only have 30 days after a QLE to make changes to your benefits.

Other allowable changes:

- You can make changes to your HSA contribution at any time.

- You can cancel your coverage at any time.