- Parkway Schools

- Frequently Asked Questions

Prop S Project Tracker

Page Navigation

- Home

- Summary of Projects

-

Projects by School

- Barretts Elementary

- Bellerive Elementary

- Carman Trails Elementary

- Claymont Elementary

- Craig Elementary

- Early Childhood Center

- Green Trails Elementary

- Hanna Woods Elementary

- Henry Elementary

- Highcroft Ridge Elementary

- Mason Ridge Elementary

- McKelvey Primary & Intermediate

- Oak Brook Elementary

- Pierremont Elementary

- River Bend Elementary

- Ross Elementary

- Shenandoah Valley Elementary

- Sorrento Springs Elementary

- Wren Hollow Elementary

- Central Middle

- Northeast Middle

- South Middle

- Southwest Middle

- West Middle

- Central High

- North High

- South High

- West High

- Fern Ridge

- Early Childhood Update (November 2024)

- History of Early Childhood Needs

-

Over the past year, several hundred Parkway residents participated in a series of community meetings to discuss the ongoing maintenance and repair needs of our aging school buildings. Their work was part of our ongoing community-led strategic planning - Project Parkway. Based on their recommendations, the Parkway Board of Education voted unanimously to place a $265 million no-tax-rate-increase bond issue on the November 8 ballot.

Download a copy of Parkway's FAQ here

Frequently Asked Questions

-

How would the funds be used?

If approved, each summer for the next six years (2023-2028), funds would be allocated for projects as shown on the following pages. The major categories of need identified include ongoing capital replacement and renovations to keep aging schools up-to-date.

-

Why are we proposing this bond issue?

Parkway has more than 3.5 million square feet of school facilities with a replacement value of more than $875 million. That’s roughly the size of operating three Busch Stadiums. The average age of a Parkway school is 54 years. These buildings are well-constructed but require ongoing updates, renovation and replacement of systems and assets just like our homes. Parkway has a responsibility to ensure these facilities are properly maintained and in good working order for current and future generations of students.

-

What is a bond issue?

A bond issue is a traditional way for schools to borrow money to pay for major school capital replacement projects such as replacing old roofs or HVAC units or making upgrades to aging buildings to keep them in good working condition for students.

-

How do schools use bond issues to benefit students?

Bond issues allow schools to pay for costly repairs and renovations over time instead of having to pay all at once. It also allows schools to devote most of their day-to-day operating budgets for classroom instruction instead of major repair work.

-

How can we complete these projects without raising taxes?

Each year, Parkway pays off old debt from previous bonds. As our loan balance decreases and our growth in assessed evaluation (property values) has grown, we are able to borrow more money and pay it back using revenue from the existing tax rate.

-

If these projects do not increase the tax rate, why do we have to vote to approve them?

The state of Missouri requires school districts to seek voter approval to re-issue bonds even if the tax rate stays the same. We also want to ensure our priorities and how we continue to invest in our facilities are aligned with our community and residents.

-

If the bond issue does not pass, will our tax rate go down?

Not for several years. As old bonds continue to be paid off, however, the tax rate would eventually be reduced unless voters approved another bond issue.

-

What would happen if it does not pass?

Some work would have to be deferred and most school renovation projects would be postponed indefinitely. The most critical capital replacement needs would still have to be addressed. To pay for this, more money would have to be spent from the day-to-day operating budget (the part that normally pays for classroom instruction, teachers, staff and supplies).

-

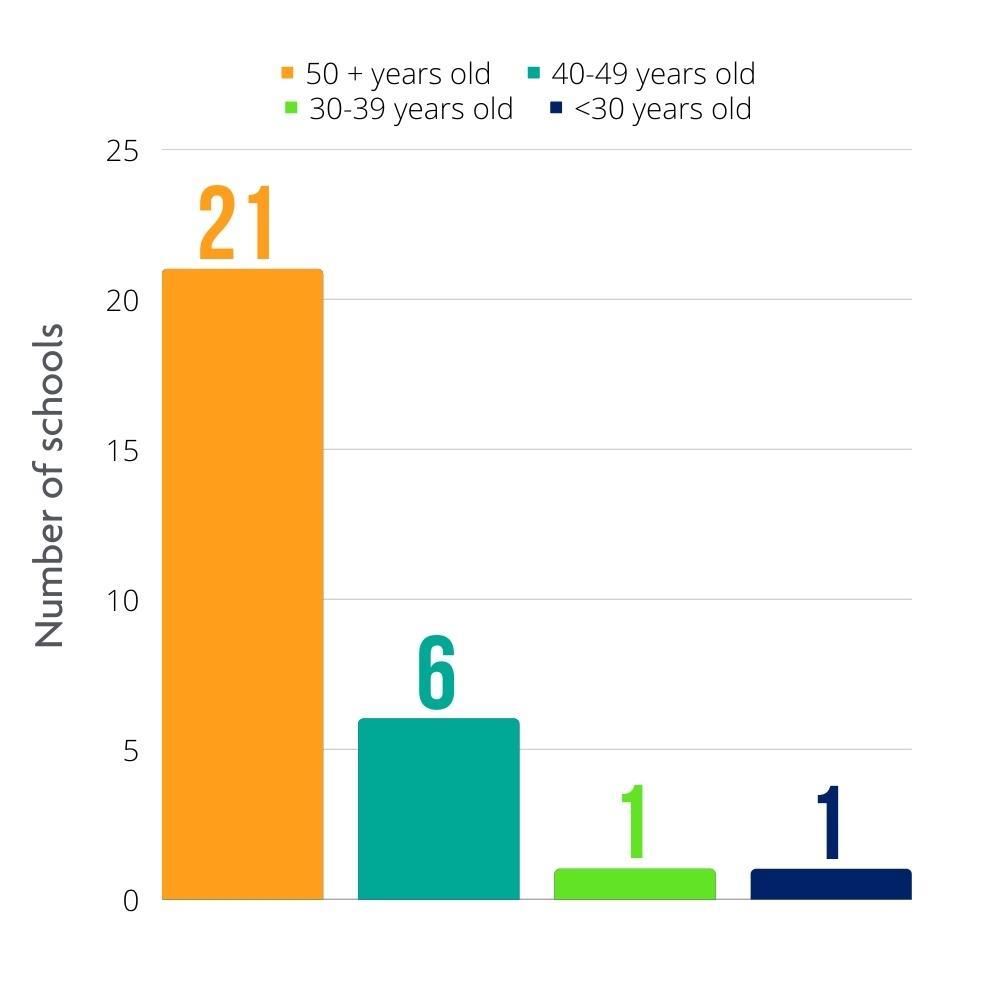

How old is the average Parkway school?

The average age of a Parkway school is 54 years old. Most Parkway schools were built between 1963 and 1971. Of the 29 schools currently in operation (K-12):

- 21 schools are between 50 and 83 years old

- 2 schools are less than 44 years old

-

How much debt does Parkway have?

Parkway has been fiscally conservative and currently only has 4% of its assessed value in debt. The state allows school districts to borrow up to 15% of their assessed value. Parkway has a AAA bond rating from Standard & Poor’s, the highest rating available for school districts. Parkway is one of only four school districts in Missouri to earn the AAA bond rating.

-

When was Parkway’s last bond issue?

In 2018 – projects from that bond issue were completed this summer. A complete list of projects from the 2018 bond issue is available at parkwayschools.net. Due to the age of our schools, Parkway typically asks the community to approve a bond issue about every four to five years. This bond issue would take us through the summer of 2028.

-

How does a bond issue work?

When voters approve a bond issue, Parkway obtains bids and sells bonds to the purchaser who offers the lowest interest rate. The district uses the funds to complete the capital projects and pays back the debt over time. This process is similar to a home loan.

-

Can the funds be used in any other way?

No. Money from bond issues can only be used for capital expenditures such as major capital replacement and renovation costs. Bond funds may not be used for operating expenses such as salaries, benefits, transportation costs, utilities, textbooks or other supplies.